A Glimpse of What You Need to Know about OWWA Loan

The Overseas Workers Welfare Association or OWWA is a membership institution that conducts programs and offers services for overseas Filipino workers or OFW. Among the services the institution offers is applying for a loan facility. This gives you an opportunity to start a new life sans the burden imposed by commercial financial institutions.

If you plan to avail of OWWA loan, here’s what you need to know about this facility before applying for one:

Basis of OWWA Loan Program

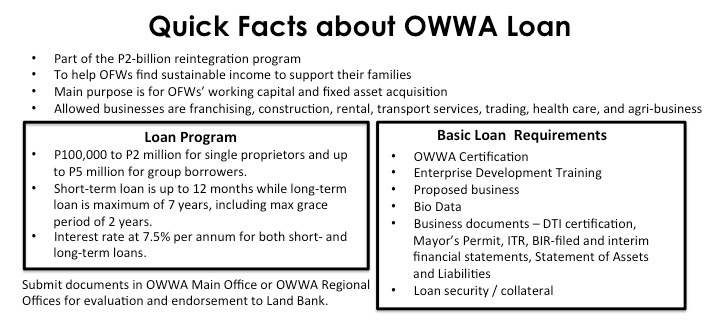

The OWWA loan is in accordance to the P2-billion reintegration program of the government to help OFWs not only find but also build sustainable businesses to support them and their families. This way, they won’t have to go back abroad to make a living and generate sustainable income for the family.

Proposed business must be in line with any of the following:

- Health care

- Agri-business

- Tourism

- Franchising

- Education

- Construction or rental business

- Transport service

- Service or trading

Likewise, the purpose of the loan must be for working capital and fixed asset acquisition only and not for personal use.

The OWWA Loan Program

OWWA allows every overseas worker P100,000.00 to P2,000,000.00 for individual borrowers and up to P5,000,000.00 for group borrowers. You have an option to avail of short-term loan, which lasts for 12 months, or long-term loans shall not exceed seven years. For long-term loans, a two-year maximum grace period is included on the principal.

Interest rate for both short- and long-term loans is pegged at 7.5% per annum.

Basic Requirements

Only OFW applicants certified and endorsed by OWWA can avail of the loan program, which will be coursed through by Land Bank. To be certified, the applicant must comply with the basic requirements:

- Overseas worker applying for the OWWA loan facility must provide a certification from OWWA to prove his/her status as bona fide OFW.

- The applicant must attend and finish the Enterprise Development Training.

- Submit proposed business together with purchase order and service contract or contract growing agreement.

- Applicant must likewise present copies of, but not limited to the following:

- Bio-data of the applicant

- Certificate of Registration with DTI

- Mayor’s permit where the business is located

- Income tax return or ITR for at least three years

- BIR-filed financial statements for at least three years, if applicable

- Statement of assets and liabilities

- Interim financial statements, if available

- Loan security or collateral, which could be the object of financing or mortgageable assets like project assets or other assets of the borrowers

Where to Submit

Once you have the necessary documents, submit the requirements in OWWA Main Office located at F.B. Harrison St., Pasay, Metro Manila. You can also submit the requirements in the nearest regional office near your area. OWWA regional offices are located in various cities in Luzon, Visayas, and Mindanao.

Loan evaluation, processing, and approval will be completed within 45 days from submission of complete requirements.

San po aq pwede mag inquire*

Hi Ravaca, please contact the lending company of your choice directly.

paano po ba maka pag loan or personal loan ang isang active ofw taga bacolod city negros occidental po ako at kasalukuyan nag tatrabaho dito sa saudi arabia. eto po email add ko ([email protected]) maraming salamat and God bless.

For OWWA Loan you will need to visit their office.

If you are still abroad, you could inquire with a lending company:

http://www.ofwloans.ph/ofw-loan/compare-loans/

Good day po.pwde mag loan ako.business po na gagawin is sugar tree plantation.maaprovahan po ba pag ganun ung bussines na gagawin ko.thanks.

Hi Jimrey, for agriculture projects there are additional requirements. Please check this post:

Enterprise Training

For specific guidance you should also contact your local OWWA office.

Hi, how can I get a seaman loan? I’m currently in manila

You can check this page to compare: Seaman Loan Comparison

Good day. Isa po akung seaman at plano ko po mag start ng buseness na manokan or native chicken farm kaso wala akung enough budget meron po ba sa owwa na mag apply ng buseness na manok yung native po my lupa ako 1000sqm at kung sakali meron sa owwa magkano ang pwedi ma loan para sa plan ko na buseness at ilang percent interest.

Hi, best you visit your local OWWA Office to discuss on your next vacation here to discuss your project and their requirements.

Unfortunately OWWA won’t accept online applications.

You can also try a private lending company: Compare Seaman Loans

Their rates will be a bit higher but they can process faster and without collateral.

PWEDE BA MAG LOAN KAHIT DI GAGAMITIN PANG BUSINESS? LIKE GAGAMITIN SA PAGPAPAGAWA NG BAHAY?

Hindi po. Ang purpose po ng OWWA Loan ay para sa negosyo. Meron po mga Housing Loans under SSS or Pag-ibig. You can check this out –

https://www.balikbayad.ph/blog/ofws-guide-on-how-to-get-a-housing-loan-from-pag-ibig/

https://www.balikbayad.ph/blog/own-your-dream-home-with-sss-direct-housing-facility-loan/

mam aisha..empleyado ga po kayo ng owwa?

Hindi po.

pwede po ba magloan even exceeding na ung business for 5months

Yes. Just present necessary documentation (financial statement, business permit, barangay clearance, etc) when you apply for a loan.

buset andami nman requirements…ubos ang ipon ng ofw sa mga requirements na yan

Hello po kasalukuyan po andito aq sa pinas,, nag aaply ulit sa hongkong.. Pwdi po ba akong makaloan…. More info. po eto ang aking number 09568717288 thank you maam and sir

HI Sarra. You can check this post for a detailed procedure on how to apply for OWWA Loan – http://www.ofwloans.ph/step-by-step-procedure-on-how-to-apply-for-owwa-loan/

Pano .mam kung wala po akong pang colateral…maka avail po ba ako..God bless po .

Hi. Required po ang collateral para makapag-loan.

Hello po…ex-abroad po aq at balak n snang mgfor good dto s pinas pwede po b aq mka avail ng loan pang umpisa ng negosyo po?

Yes, you can avail of a loan, although OWWA is strict when it comes to requirements. For more convenient loan application, you may check out Balikbayad – https://www.balikbayad.ph/

Hi good day po…ofw ho ako at gusto ko maka available sa ofw loan.. Rice field ang gusto ko e business…ask lamg ako ng advice kong pwede ho na ito…thanks

Hi Arnold. Yes, you may apply for a loan for that type of business.

Paano po kung hindi sa business, kundi sa Housing, gagamitin ang loan ppwede po ba mag avail?

HI Louie. The OWWA Loan is specifically for business purposes only. You can check government agencies like PAG-IBIG or SSS since they offer Housing Loans.

Good morning po, d2 po ako sa saudi,gusto ko pong mag cash loan for renovation sa bahay ko po kaso lang wala po akong pang colateral poide po ba yun.

You may apply with a co-maker. However, OWWA Loan is for business purposes only. You can consider private lenders for this type of purpose.

Ako p si Alvin Molina tatanong ko kung puwede ko gawin colatteral yung apartment house n bibilin kp gamit ang parang hihiramin k pong pera s inyo I susurender kp titolo s inyo!pls reply p salamat p

Hi. OWWA Loan is for business purposes only and hindi po pwede gamitin for purchase ng property.

hi matutulungan po ba ako ng owwa kakauwi ko lng po last may..ayaw ko na po bumalik abroad makakaloan po ba ako? please answer me po salamat po

If you are still an active OWWA member, maaari ka mag-apply ng loan para makapagsimula ka ng kahit maliit na negosyo. Otherwise, you can try private lenders din since hindi sila ganun ka-strikto sa mga requirements.

Hello po.. Ask ko lang po if pwede po ba na ako na wife ang mag apply ng owwa loan if ever po na nasa ibang bansa na ang aking husband?

OWWA requires the OWWA member to apply. Pero kung meron po kayong Special Power of Attorney na ina-allow kayo ni husband to apply, maaaring ma-process ang loan application.

Mam gud pm gusto ko po magloan bibili po ako ng lupa at pagawa ko ng appartment kelangan pa ba ng colateral seaman po ako.

Hello Jose. We’re not sure if this will be allowed by OWWA. Nonetheless, maaari parin naman kayo sumubok. Kailangan po ng pang-collateral since ito ang mag-gagarantiya ng mababayaran ang loan anuman ang mangyari. Kung wala naman, you can apply with a co-maker, although walang kasiguraduhan ito.

Hi,ex abroad po ako,last 2016 ako nka uwi…if i avail the loan pwd na ba ung bigasan para mka pagstart?then how to prevent business permit sa location kung tsaka palang magstart pag release sa ni loan?tnx…..

Hello Jushel. Business permit is among the requirements when applying for a loan because OWWA and Landbank need to see that you are running a legitimate business. This is a mandatory requirement. Regarding sa business, it’s up to you po kung ano ang gusto ninyong simulan as long as the business is allowed by OWWA. You can attend the Enterprise Development Training to help you decide kung anong klaseng business ang mas babagay sainyo and what to expect kapag nagne-negosyo. Thanks!

good day po,

isa po akong seaman at nais ko sana mag loan sa owwa ang tanong ko lang po kung pwd ko po bang gamitin property ng parents ko pra e collateral sa loan at yung itr na rin nila gamitin ko pra sa requirements.

Hi Joey! Unfortunately, hindi po iyon pwede dahil ikaw ang magiging principal borrower and not your parents. What you can do po is you can use other forms of assets under your name like time deposit or savings account as collateral 🙂

hi po.How about boarding house,is it qualified bussiness to avail the ofw loan?Paano po kung wala pang lupa na na acquire para patayuan ng boarding house,makakapag loan po? I will look forward for your reply.thank you po

Hello Marie! This is a good business, although we’re just not sure if OWWA will allow this dahil wala pang definite place ang boarding house na nais mo po patayuan. Hope this clear things up. Thanks!

Good day po..uwi po ako March for good na gusto ko magloan for salon business worth of 1M..pwede ns po bang collateral ko po Yong binili kong house & lot wOrth of 2M kaso wala pa pong titulo on process pa at meron po akong lupa may titulo na na kapangalan pa rin sa tatay ko

Hi Rome. It’s good to know about your intention to open your own business. For the collateral, you can submit a copy of the Deed of Sale as proof na nabenta na sayo ang lupa and perhaps, execute an affidavit stating na processing na ang pag-transfer sa iyong pangalan. Hopefully, OWWA will allow this 🙂

Hi Good Day Owwa..

PWEDE PO BA MAG LOAN MAGPAPAGAWA NG BOARDING HOUSE AS BUSINESS.. SEAMAN PO AKO AT MAY OWNED LOT AT THE BACKDOOR OF CARAGA STATE UNIVERSITY.

Hello Larry! We think this is a legitimate business plan, but we are not sure if OWWA will accept this. This is why importante din po mag-attend ng Enterprise Development Training to help you determine the viability of your chosen business 🙂 OWWA will also help you and give you insights kung paano pa kikita ang iyong proposed business. Thanks!

Hello po! OFW po ako dito sa Milan Italy, like ko po sana mag attend ng business seminar sa Philippines, kc dito sa Milan wala po kcng idea kung kelan sila mag conduct ng seminar. Paano po kaya mag pa sked ng seminar, kc itaon ko po sana sa vacation ko para di naman po masayang pag uwi ko, that’s in August. Ask ko na rin po about colateral, since Plano ko po sana Apartment or small Condotel, ok lng po ba na deed of sale ng lote? Thank u po sa reply

Hello Sheila! The seminar po depends on the Regional Office and we don’t know when the schedule will be. We suggest po that you coordinate directly with the OWWA Regional Office near you for the schedule since they are more capable of addressing this concern. Please check this link po for contact details – http://www.owwa.gov.ph/?q=content/contact-us

Hi Sir/Madam,

Ask lang po ako Plano ko na mag stay ng pilipinas para magkaroon ng business like water reffiling station,or bigasan ,pero wala pa po ako mga requirements like business permit BIR and etc. Kasi mag start pa lng po ako 6years na po ako nag nagtatrabaho sa Riyadh KSA Bali finish contract na po ako this month of April 2018 pwede po ba ako loan ng business financial for start the business thank you po for your guidance.

Hi Ronald! Hinihingi po ng OWWA ang existing employment contract. Hindi din po kami sigurado if i-allow nila ang ex-OFW.

Paano naman magiging possible ang loan na ito sa OFW, eh mas mahirap pa ang qualification, requirements and availments sa pagpasok sa butas ng karayom. Gusto nyo ba talagang tumulong sa OFW? Eh parang ayaw ninyo naman sa sobrang hirap. Yun na lang EDT my goodness gracious. Tapos yung three years pa upon arrival s Phils. seems ridiculous. Tell me honestly, may naka avail na ba ng loan ninyo? Paano na ang contribution namin?

Mabuti pa mag bifay na lang kayo ng pension sa returning OFW. Aba sa tagal at dami na ng contribution namin dyan. Wala kaming pakinabang. Tapos magpa loan kayo. Mataas pa sa coop ang rate of interest at super duper ang requirements. What?

Hello Edna. We understand your sentiments. Unfortunately, this is OWWA policy and we are merely relaying the information given by them. If you’re wondering if may nakaka-avail ng OWWA Loan, yes, there are OFWs who were granted this type of loan facility.

seafarers po asawa bale gusto po namin mag put up ng.business pwede po ba mag.loan kaso wala po.kami pang collateral tska paano at kung pwede po ba?

Hi Julie. What others do is they apply with a co-maker, preferably someone who is in good credit standing at may kakayahan na magbayad ng utang kung sakali.

how can you even provide an ITR for three years when you were not in the Philippines for several years.Another thing is, You would like to borrow a business capital to put up a business to earn money back here and the Philippines. And because you do not have any property to sell or pawn, otherwise you will not intend to borrow from this government just to put up a business.One might just borrow from a bank or wherever, less hassle and less requirements to do.Where is the so-called benefit here? I was an OFW for 12 years and I got nothing from OWWA. Now, they say there will a “Rebate for those who did not avail of any loan.Where is it? 1 year,2 years of “actuarial study”? come on people!