There are two types of Overseas Filipino Workers or OFWS: land-based workers or seafarers.

According to the Migrant Workers and Overseas Filipinos Act of 1995, overseas Filipino worker or migrant worker is a “person who is to be engaged, is engaged, or has been engaged in remunerated activity in a state of which he or she is not a citizen (land-based) or on board a vessel navigating the foreign seas other than a government ship used for military or non-commercial purposes, or on an installation located offshore or on the high seas.” (seafarers)

Here’s the next question: Can seafarers also apply for OWWA loan?

Read on to find out.  The P2-billion OFW Reintegration Program

The P2-billion OFW Reintegration Program

The government provides many benefits for OFWs, whether you are land-based or working on seas. One of them is the OWWA loan under the reintegration program.

The main purpose of this program is to provide enterprise development intervention and loan facility for OFWs and their respective families. It also helps migrant workers to establish a viable business enterprise that could provide you a steady income and at the same time, create employment opportunities for people in your community.

Does this include seafarers?

The program does not define what type of overseas Filipino worker is covered by OWWA loan. Rather, the program highlighted “OFW who is also a certified OWWA member” as eligible borrowers, which means the borrower can either be land-based or a seafarer. At the same time, Overseas Workers Welfare Association or OWWA is mandated to provide programs for sea-based migrant workers including loan programs such as OWWA Loan.

This means as long as you belong to the OFW category, regardless if you are working on land or in the sea, you can avail of this type of loan facility. This also means as a seafarer, you can apply for OWWA loan in case you want to put up your own business allowed by the program, allowing you to borrow from P100,000 to P2 million.

Know more about OWWA Loan here.

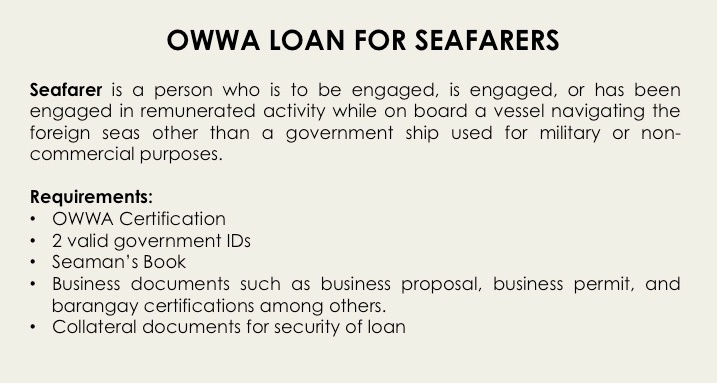

Requirements for OWWA Loan for Seafarers:

In case you want to apply for a loan, you also have to submit certain requirements to process your application. This includes but not limited to:

- OWWA certification stating that you are a bonafide OWWA member.

- Special Power of Attorney (SPA) duly authenticated by the Philippine consul in case you are not in the Philippines.

- Two (2) valid government IDs

- Passport

- Seaman’s Book

- Proof of Billing

- Business documents such as business proposal / feasibility study, business permit, and barangay certification where the business is located among others.

- Collateral documents for security of loan such as real estate mortgage or chattel mortgage.

For detailed list of requirements, click here.

When availing of OWWA loan, you also need to undergo Enterprise Development Training as part of the requirements. Click here to know more about this.

Keep in mind that you need to go through a process for the approval of your OWWA loan. This post will give you an idea as to the step-by-step process when applying for this type of loan facility.

It doesn’t matter whether you are a seafarer or working on the ground. The government provides benefits for Overseas Filipino Workers for all the hard work and contribution you are giving to the country.

Good morning. My husband is a seafarer. I just wanna ask if there’s a housing loan too. Please send me private message.

Yes

OWWA Loan doesn’t cover housing needs since it is for business. For Housing Loans, you might want to check these links –

https://www.balikbayad.ph/blog/ofws-guide-on-how-to-get-a-housing-loan-from-pag-ibig/

https://www.balikbayad.ph/blog/own-your-dream-home-with-sss-direct-housing-facility-loan/

Hello,

Can I apply for a loan if I am currently working in Dubai? Do I need to go back in Philippines for this application? Please advise what should I do in this case. Thanks.

Hi Morales, you will need to apply in person, so plan to visit them on your next vacation.

I am a seafarer.I’ve been on vacation for 5 months already.Our ship has been sold last Jan.2017 and my contract suppossedly finished this coming August. Temporarily,I’m driving a car under UBER to sustain our daily needs.Can I make a car loan for OWWA?Do I need trainings to avail the loan?Thanks.

how much interest per month for seaman’s loan?.

Please proceed to your local OWWA Office to get a computation.

Also have a look at our our comparison for private lending companies so you can compare the offer: Seaman Loans

Seaman po ako pwede na po b akong magpasa ng application khit di p po ako nkapirma ulit ng kontrata?.nung april po ako dumating etong august po alis ko.thanks in advance.

Hi Victor. As long as may proof of employment at siguradong makakaalis ka, maaari ka mag-apply.

hello i am a seafarer and i have an exsisting business furniture shop i want to loan but i dont have a collateral i see one of youre requirements need….so can i have still a loan without any collateral….

Hello, OWWA requires collateral. Still, you can consider private lenders since they are more flexible when it comes to requirements. you can check out this link fo the comparison of rates – http://www.ofwloans.ph/ofw-loan/compare-loans/

Kakauwi q lang po..me 1 year pa pong remaining ung contrata q as a fisherman sa taiwan..pwd po b aq mgapply mam?

Kinakailangan po na may existing contract kayo upang makapag-loan sa OWWA. Kung nandito po kayo para lang sa bakasyon, maaari itong payagan ng OWWA.

Seafearer po ang asawa ko at kasasakay lng po nya last august 2017 pwede po n ang asawa ang mg process ng loan s owwa? Pwede po bang i collateral kahit deed of sale lng hawak ndi land tittle??

Borrower must be the OFW-OWWA member.

Hello good day! How about for good na ang ofw? Is there’s a possibilities for loans padin ba? Like ggamitin for business.And wala ding collateral which is in your requirements.Thanks

Hi, most loans for business require collateral, although not necessarily property. OWWA Loan is for OWWA members with existing employment contract. You can try private lenders to help you start your business. Please check our loan comparison table here – http://www.ofwloans.ph/ofw-pricing-comparison/

I’m seabase and intend to loan for agri equipment procurement of harvester and tractor.

Hi Sir. You need to attend the Enterprise Development Training (EDT) as part of the initial requirements for OWWA Loan. Once you’re done, you can start submitting the loan requirements such as proof of OWWA membership, seaman’s book, collateral documents, and business documents that were done and completed during the EDT. Please allow Landbank to process your loan application within 40 days and then you will be informed if you are approved or not.

Hello good day, may hinuhulugan po akong pre selling na lot only for 5years at nka 2years nkong hulog ,pwede ko po bang ipasok sa loan ito pra mafully paid ko npo ung payment

Hello. OWWA Loan is specifically for business purposes only. Hindi po tatanggapin ni OWWA ang purpose since hindi ito covered ng OWWA Loan. We suggest that you apply with PAG-IBIG or SSS Home Loans since they cater more to that need. Salamat!

Puede konpong malaman, kung mkkpag loan ako ng 1M how much po ang magiging monthly at ilang years to pay po.

Hi Janet! Interest is at 7.5 percent per annum, so P1 million x 7.5 percent x 30 / 365 days 🙂 We’re not sure if this is the same computation followed by OWWA.

Hi po ako po si Juanesa D. Maribbay 9YRS. PO AKONG NAG OFW DIFFERENT COUNTRY. NGAYON NAGTAYO NLNG PO AKO NA KARINDERYA 11YRS. NA PO AKO DTO SA PILIPINAS PWEDE PO PA BA AKO MAGLOAN SQ OWWA DAGDAG PUBUNAN PO

Hi Juanesa. Ang OWWA Loan ay ibinibigay po sa mga OFWs na may existing Employment Contract. You can try private lenders instead of banks since mas maluwag po sila pagdating sa requirements 🙂

Good day Sir/ma’am nais ko po sana magloan, ano po ba mga exact requirements, nais ko po magtayo na small business, o depende po sa pinag iisipan ko negosyo, ano po ba exact requirements para ako ma approved thanks po

Hi Edmundo. The post indicates the requirements na po that you need to prepare when applying for a loan. Thanks 🙂